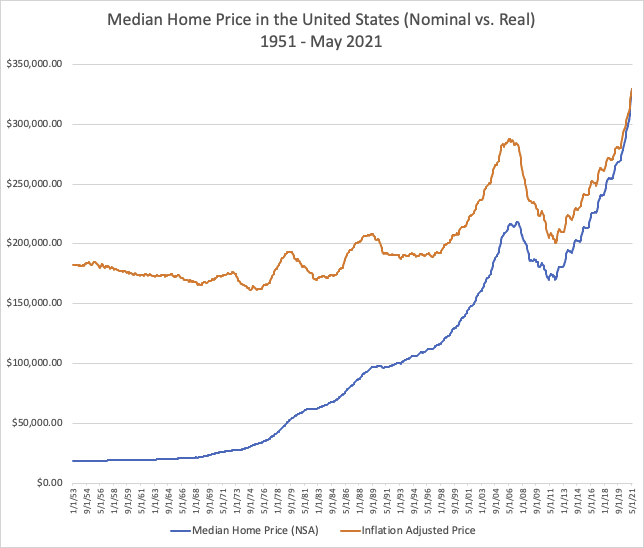

It’s late 2021. For at least four years, people have been crying out that the housing market is due for a crash. “The housing market is cyclical,” they say. And they are not wrong. It’s just that the cyclical nature of it doesn’t help predict when. Even in the last few months, rumors of a slowing down in the market have been swarming. It’s not too hard to believe when you look at this graph:

The market seems pretty cyclical, right? And this graph is almost begging for a crash. The last one took almost 20 years to occur though, so the ten year dogma doesn’t really seem to hold up.

In medicine, we always want to look for the underlying cause of a medical problem. Correct that cause (early enough) and we can prevent disease. In real estate, it is supply and demand, but also interest rates. Most real estate is purchased with a loan. As the Fed decreases interest rates, people will pay more for their property because they will pay comparatively less per month.

In a time where interest rates are low, people can pay more. We also know that currently there is big demand for housing with not enough construction. Construction has been impacted by supply-chain issues with the pandemic, resulting in decreased supply. So, we have high demand, low supply, and low interest rates. This results in houses flying off the market for over asking price as desperate buyers make concessions and pay more for their new homes.

How could a crash happen? In 2007, we had the subprime mortgage crisis. Banks were allowed to make loans to poorly-qualified people. These loans were backed by private mortgage securities. Because more people could purchase a home, demand increased, followed by prices. Almost 70% of US adults owned homes. Many of these people found they couldn’t make the mortgage payments, and began to default. This caused subprime mortgage lenders to collapse. After this collapse, lenders weren’t doing subprime lending any more. Prices slid. People became fearful of buying, decreasing demand.

In the early 90s, the Savings and Loan Crisis came about because of excessive lending and high interest rates set by the Fed. This caused a recession and a 7% drop in home values. High interest rates meant that less people could get a loan for their dream home. This decreased demand and decreased prices.

As long as interest rates remain low, we will likely continue to see high demand for homes. Supply will remain low for the foreseeable future, at least until the supply chain disruption is corrected. I don’t see much decrease in price in building materials in the future, perhaps a slowing of the rapid growth, however. I will be looking at the home ownership rate. A certain percentage of people will get loans and not be able to pay. As home ownership increases, a larger chunk of people will not be able to pay their mortgages. We are at 65% right now. When this number gets near 70% be wary.

This article from HousingWIre claims that the housing market is still red-hot. It states that demand continues to go up and new listings continue to decrease. Lower supply and higher demand, means increasing prices. The article gives numerous reasons the market is still hot; yet, it can’t resist making a small statement at the end of a possible cooling-off coming. So, who knows?