Interest rates dropped 0.5%! That’s a big one. I just purchased my 226 unit Bismarck deal and got a sweet 8% rate. It’s easy to look back and say “I should have waited.” But then my deal would have evaporated. Trying to time the market is foolish for that reason. You just need to adjust your purchase price to account for what you will be paying to the bank. Likely if we were still negotiating on the Bismarck deal the seller would be arguing how much money I would save with the rates going down and not wanting to deal on anything else of which I was asking. It’s all tied together. Don’t get fixated on the rate as the reason to invest or not.

You may recall from July that I predicted we would have two modest rate cuts this year: 0.25% each. I was wrong. It was a 0.5% cut. Will there be more? Don’t expect anything for at least 6 months.

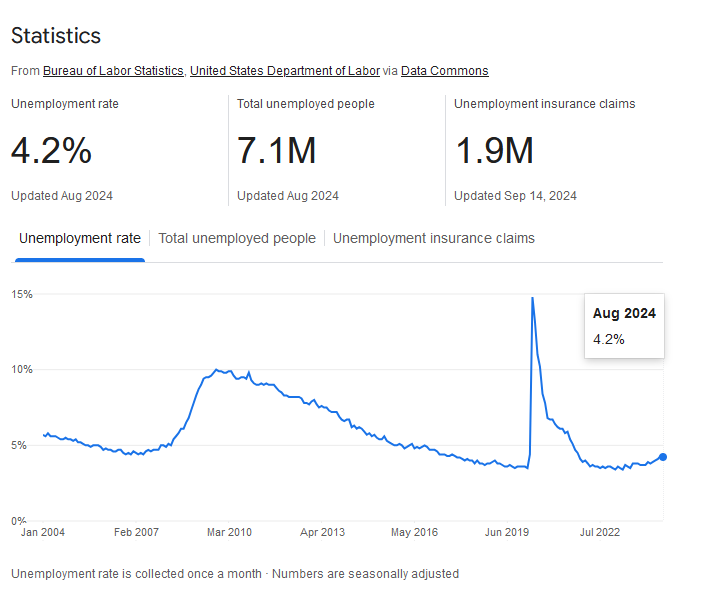

I’m very surprised that they cut it 0.5%. That’s a big move designed to make headlines – which is designed to move the market. Which is surprising to me as I thought the FED would try to stabilize where we are with smaller incremental moves. They are hoping for a big win on unemployment. Look at what it has been doing:

If you’ve been following my posts, you know I believe the FED watches unemployment more than other metrics. Let’s look again in 6 months and see what the unemployment rate is doing and what the FED does. I bet we will see another cut and it’ll be 0.25%. See you then.