You know I love equity way above cash flow in my investments. The only time you really want to maximize cash flow is when working with investors or when you are just starting and trying to scale fast. Either of these is going to have a lot of tax disadvantages, but could still be right for your situation. For the rest, its equity. Which is why I get so angry at people misusing the Cash-on-Cash return metric.

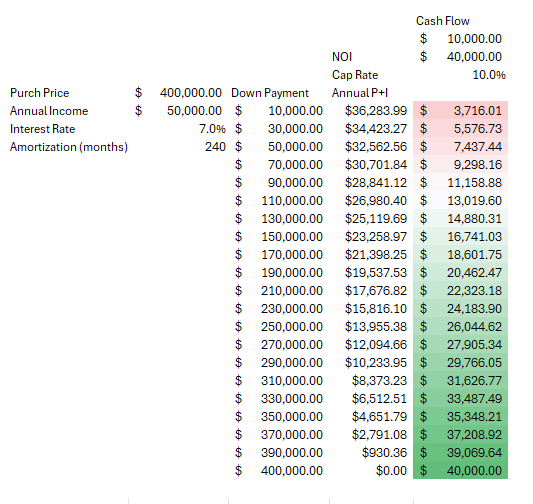

The scenario is this: They want to buy a $400,000 property. They want to maximize the cash on cash so they want to put as little down as possible. That will have the effect of minimizing the equity and putting the cash on cash much higher. Let’s say they could get a loan for 7% rate right now with a 20 year amortization. The place brings in $50,000 annual income and has some crazy low $10,000 expenses, which gives them an NOI of $40,000.

When they look at the cash on cash return of the property they find that the lower down payment they put in, the higher the cash on cash return gets. It seems obvious that they should put in as little as possible, but is this actually true?

Here’s a spreadsheet of the numbers in question:

Slam dunk decision, right? Go with as little down as you can. But here’s what they miss on the actual numbers:

A huge cash on cash return of 37.2% suddenly becomes an ugly $3,716.01! Sure, they get a big return on a low risk 10k investment, but 40k return on $400,000 seems much better to me. Of course, it would be better to get 40 deals with the 10,000 down payment, but who is going to be able to buy 40 deals in a year? Not me.

Clearly, you can’t use just the cash-on-cash return metric to decide whether to do a deal or not. Make sure you look at all the possibilities holistically before landing on a yes or no.